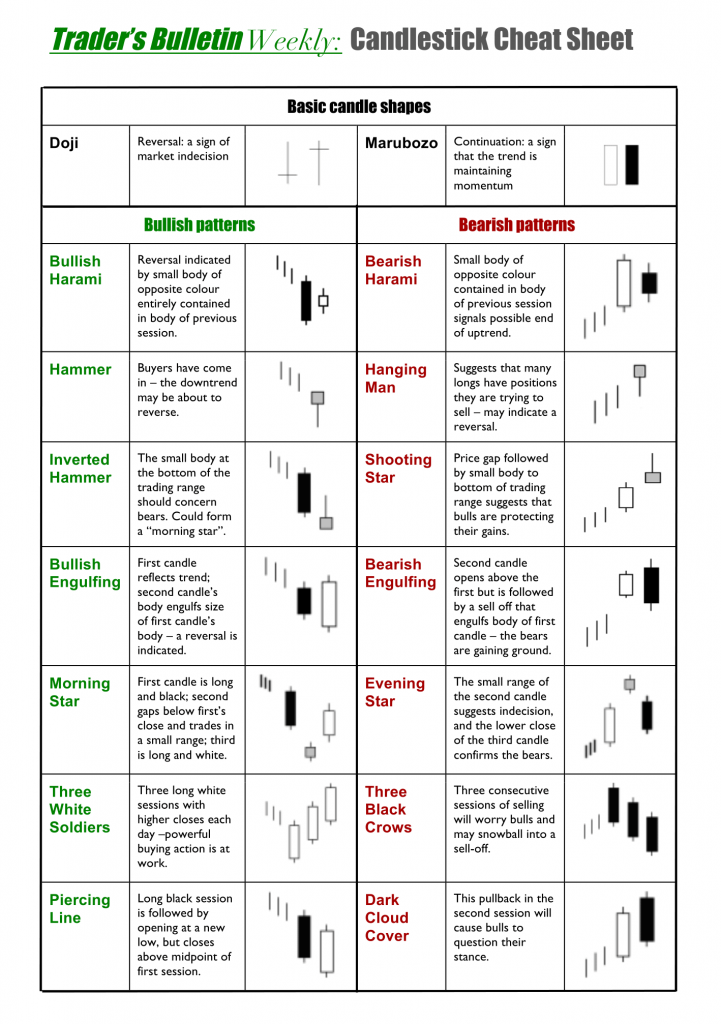

Single candlestick patterns are the most common type of pattern, making up most of the candlestick patterns we see on our charts. Understanding these patterns, while not super important for analysis, can help determine when prices are in a period of indecision. These patterns form when the bulls and bears battle it out but come to an impasse, resulting in neither side gaining control and causing an indecision candle to form. Indecision patterns make up most candlesticks on our charts. The most common type of pattern… and the least useful. They’re most useful for getting into trending moves or adding to existing positions. When they form, price has a high probability of continuing in the direction it was moving in before the pattern appeared. These patterns prove some of the most useful, often being used as confirmation signals for technical strategies, and come in both bullish and bearish varieties.Ĭontinuation patterns signal a continuation – hence the name – of the prior movement or trend.

Reversal candlestick patterns indicate price may soon reverse and change direction. Moreover, these patterns are further classified into three types, each hinting at possible price movements post-appearance. These 12 key candlestick patterns fall into three separate categories based on the number of candles that make up the pattern: single candle, two-candle, and three-candle. In fact, keeping an eye on 12 patterns will do the trick – and of these, 7 are relatively rare. Seen at a demand zone, it’s a solid indication buyers are keen on reversing the current price direction, raising the chances of a reversal from that level.įorex boasts around 32 distinct candlestick patterns.īut here’s the catch – you don’t need to master all of them to be successful. Many of these patterns can also act as confirmation signals when paired with other technical trading strategies.īullish Engulfing candlesticks are a clear signal bulls have outpowered the bears – a potential sign of a market reversal. This knowledge can sharpen your predictions about upcoming price shifts, helping you seize the advantage. The predictive power of these patterns not only deepens your grasp of the market but also clues you in on the behind-the-scenes thinking of traders. Learning the most common candlestick patterns can give you a significant edge. These candlesticks serve as a window into the market mindset, which you can leverage to anticipate upcoming price movements. Remember, every pattern forms as traders buy and sell based on their future market predictions.

0 kommentar(er)

0 kommentar(er)